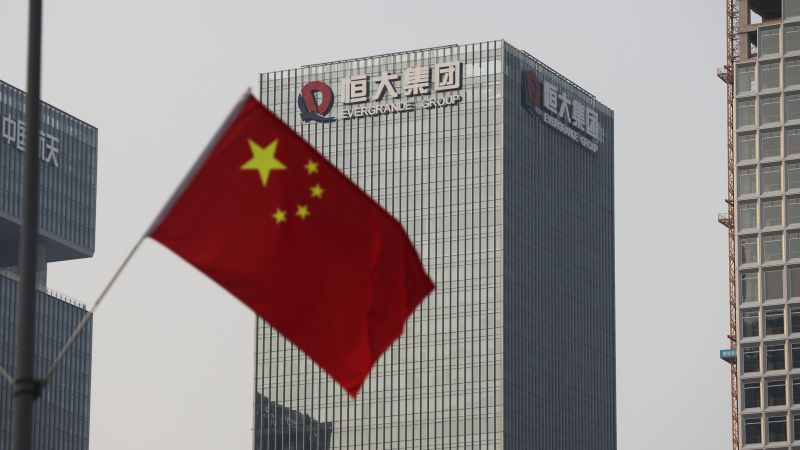

China’s Evergrande Group, once the country’s second-largest property developer, has filed for bankruptcy in New York. The company’s massive debt default in 2021 triggered a property crisis in China’s economy, with far-reaching consequences. Evergrande has sought Chapter 15 bankruptcy protection, which allows a US court to intervene in cross-border bankruptcy cases. The company’s financial struggles are evident in its inability to pay off its loans, which amount to 2.437 trillion yuan ($340 billion) or 2% of China’s GDP. Additionally, Evergrande reported a loss of $81 billion in shareholder money over the past two years. The fallout from Evergrande’s collapse has affected other major developers in China, leading to defaults and financial instability. The situation has become so dire that even Country Garden, another real estate giant, is considering debt restructuring. Earlier this year, Evergrande unveiled a debt restructuring plan, the largest in China’s history, to alleviate its offshore indebtedness and resume operations. This is a developing story, and updates will be provided.

Unveiling China’s Evergrande: A Landmark Bankruptcy Filing

In a move that has sent shockwaves through the global financial markets, China’s Evergrande Group, one of the country’s largest property developers, has filed for bankruptcy. This landmark event marks a significant turning point in China’s economic landscape and raises concerns about the stability of the world’s second-largest economy.

Evergrande’s bankruptcy filing comes after months of mounting debt and financial troubles. The company, which has been a symbol of China’s rapid urbanization and economic growth, has been grappling with a staggering debt burden of over $300 billion. Its inability to repay its creditors and meet its financial obligations has led to a series of defaults and sparked fears of a potential systemic crisis.

The repercussions of Evergrande’s bankruptcy are far-reaching, both domestically and internationally. Domestically, the collapse of this property giant has raised concerns about the stability of China’s real estate market, which has been a key driver of the country’s economic growth. Evergrande’s failure could trigger a chain reaction, leading to a sharp decline in property prices, a surge in unemployment, and a slowdown in economic activity.

Internationally, the fallout from Evergrande’s bankruptcy filing is also significant. The company’s extensive overseas investments and partnerships have left many foreign entities exposed to its financial troubles. Global investors, including major banks and institutional investors, are closely monitoring the situation, fearing potential contagion effects that could spread beyond China’s borders.

The Chinese government’s response to Evergrande’s bankruptcy filing will be crucial in determining the future trajectory of the country’s economy. Beijing has so far adopted a cautious approach, avoiding a direct bailout of the company and instead encouraging a market-driven resolution. This approach reflects the government’s broader objective of reducing excessive debt and curbing speculative activities in the real estate sector.

However, the risks associated with Evergrande’s bankruptcy cannot be underestimated. The company’s vast network of suppliers, contractors, and homebuyers, who have paid deposits for yet-to-be-completed properties, are all at risk of significant financial losses. The potential social and economic implications of such losses could pose a serious challenge for the Chinese government, which is already grappling with a slowing economy and rising social inequality.

The Evergrande saga also highlights broader issues within China’s financial system. The country’s highly leveraged corporate sector, coupled with a lack of transparency and regulatory oversight, has created an environment ripe for financial instability. The government’s efforts to rein in excessive debt and address systemic risks will be crucial in restoring confidence in China’s financial markets and preventing future crises.

As the dust settles on Evergrande’s bankruptcy filing, the world will be closely watching how China manages this unprecedented situation. The government’s ability to strike a delicate balance between containing the fallout from Evergrande’s collapse and maintaining economic stability will be critical. The outcome will not only shape China’s economic future but also have implications for global financial markets and investor sentiment.

In conclusion, Evergrande’s bankruptcy filing represents a landmark event in China’s economic history. The collapse of this property giant raises concerns about the stability of China’s real estate market and the broader implications for the country’s economy. The Chinese government’s response and its ability to address systemic risks will be closely scrutinized. As the world watches, the fate of Evergrande will undoubtedly have far-reaching consequences for China and the global financial landscape.